After Google Flights which we particularly appreciate to prepare our flights, Google has just launched its equivalent for hotels: Google Hotel Search.

Logically, this release raises two questions: how does it work (and what is the value for the customer) and what impact can it have on the industry (risks and opportunities for the professionals).

If you are on the customer side the first part of the article is for you, if you are a hotelier or an online travel agency it is the second.

The Google Hotel Search Experience

We land on a sober interface, “à la Google”.

Just enter a destination, departure and arrival dates and you’re done. We land on a simple and readable interface. On one side a list of hotels, on the other side a map of the city which allows to visualize the prices according to the location of the hotel.Of course it is possible to refine your choice. For example, based on the ratings that guests have given to the hotel.

Or according to the facilities and services offered.

Or by hotel category.

Everything is simple, intuitive and fluid. A treat. On the other hand, it’s a shame not to be able tofilter by hotel brand or hotel group, as is the case with Google Flights, which would make it possible, for example, to have only the hotels participating in such and such loyalty program.

Once you have chosen a property, Google Hotel Search offers a summary sheet.

You can see photos, customer ratings, a selection of similar hotels nearby as well asrates offered by OTAs (online travel agencies) or even on the hotelier’s website.

Strangely for these dates I was not offered to go directly to the website of the hotel while for another yes.

Different tabs allow you to go into the details of the proposed information.

Starting with the available rates. Like Google Flights, Google Hotel Search does not allow you to make reservations but refers you to professionals.

There are several options: you can search for the dates when this hotel is the cheapest or compare to similar hotels.

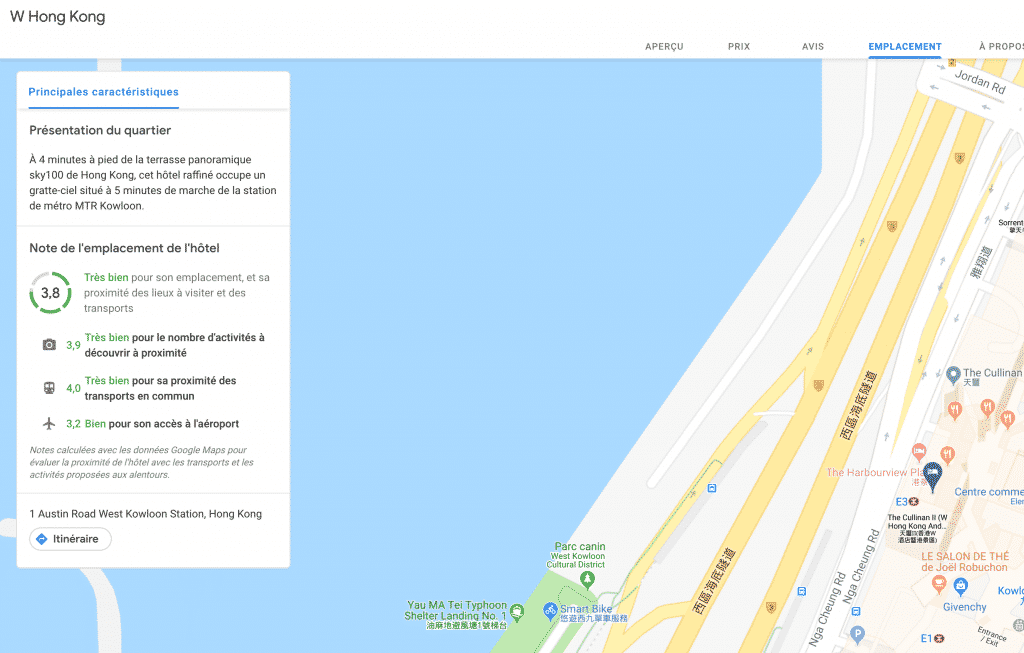

Another interesting feature, Google Hotel Search allows you to see the reviews given by customers. But instead of just ratings and reviews left on Google we have an aggregation of reviews left on the main OTAs (Booking, Edreams, Expedia, Ebookers…) but also on TripAdvisor. In some cases we even have the reviews left on the hotelier’s website. In the case of the W Hong Kong, the information was not available, but it worked for the Intercontinental.The location tab shows not only the location of the property but also a rating, its strengths and weaknesses.As for the “About” tab, it gives information about the hotel and its services.

And finally the photos tab….

I think that all this speaks for itself: Google Hotel Search is perfectto easily find, compare hotels and especially choose the best price without having to wander from platform to platform to compare. It has its own information for a part and for the rest plays the role of a meta engine.

If we overlook the impossibility of sorting by brand / loyalty program, the tool is almost perfect and will undoubtedly become part of TravelGuys’ travel planning toolkit.

It goes without saying that we expect a very strong adoption of Google Hotel Search by the end user for whom it will really change the game.

But if Google Hotel Search is going to be a game changer for travelers, what about for industry professionals?

Google Hotel Search: the hoteliers’ friend.

What does Google Hotel Search change for hoteliers? The good news is that it doesn’t give them more work to do: it’s not another platform to manage but only an aggregator.

On the other hand, without any surprise, the Google Search results are at the top of the Google results page. It is true whether one simply requests a hotel in a city…

…or a particular hotel.Bad news for hoteliers who will again see someone passing them in the results pages? Not necessarily so.

Not all hoteliers have a SEO that allows them to be ahead of the OTAs in the results pages, and we will see that having a new player go ahead of everyone is paradoxically good news for them.

Then not all hoteliers have the budget that OTAs invest to appear at the top of the pages.

My prediction is that Google Hotel Search will “steal” more direct traffic from OTAs than from hoteliers.You’re going to tell me that it’s a shame for hoteliers to see Google become the gateway to the customer if it sends all the traffic back to the OTAs…well no!

You will have a more detailed and argued article on the subject soon, but Google Hotel Search will dramatically change consumer behavior. It used to visit one or two OTAs and compare the hotels on each. Now thanks to Google he will first choose his hotel and then compare prices because for the first time he will have a meta engine that will allow him to compare the rates of OTAs between them but also with the rates of hoteliers in direct purchase. And the customer will realize that in the vast majority of cases the hotelier is cheaper than Booking, Ebookers and co (we will see in this same future post that technically speaking you will pay less by booking directly in almost 100% of cases).

By making this comparison possible Google Hotel Search will kill the myth that Expedia, Booking etc are cheaper and offer good deals and bring back traffic to hoteliers for direct booking (I remind you that a hotelier pays almost 20% commission to OTAs on each booking they bring them). So yes for the hotelier it is a real chance! It will be “enough” to display prices cheaper than the OTAs which will not be too complicated because not paying commission on a direct sale he can have rates almost 20% less than the OTA without losing money.

To date Google Hotel Search does not allow sellers to “boost” their position in the results by paying but I think we should expect to see this more or less quickly.

OTAs: the distracted disruptors

There has been a lot of talk about uberization in recent years and historically one of the first sectors to be uberized was the travel industry with the OTAs! Able to offer an infinite choice, capable of systematically appearing in the best results of search engines and often in front of hoteliers, they have become the gateway to the customer and have “stolen” the customer relationship from the hotelier by taking, in addition, a commission. The perfect hold-up!

Well, Google Hotel Search is doing exactly the same to them. They will never be able to be at the top of the rankingsand will only be visited by customers who will have chosen them on Google Hotel Search, therefore a priori if and only if they display a lower rate than the hotelier in direct. And there they start with a handicap: the hotelier has a head start”in his ability to lower prices because, let’s repeat it, he can drop the equivalent of the margin he would pay to the OTA without losing money or reducing his own margin.

Google Hotel Search: winners and losers.

In the end there will be winners and losers in this case.

The OTAs are the big losers of the story with a Google Hotel Search that will become a “One Stop Shop”, the inevitable entry point for the customer and his tool to help him choose. They will clearly lose their grip.

As for the hotelier, he will find in Google Hotel Search a partner of choice in his fight against the OTAs because unlike the latter, Google is not a competitor. They just need to adopt the right pricing policy.

The customer finds himself with a first-class selection tool and a meta-price comparison engine that did not exist until now. It is all the more profitable for him because the war will now be fought more on price.

And the big winner is of course Google which will of course capture even more traffic but with a downside. In a world where Google Hotel Search reigns, what is the interest for a hotel or an OTA to pay for sponsored links? In my opinion none so it’s potentially a loss of revenue for Google which I think will be quickly compensated by the ability to do the same thing within Google Hotel Search. I’m curious to see the impact in terms of budget allocations of a model where the battle is fought more on rates than on paid search.